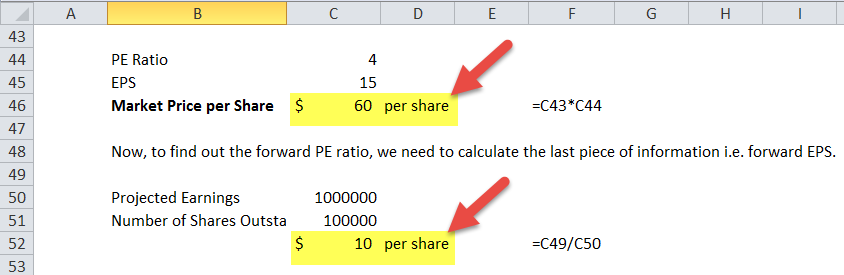

52+ the price-earnings ratio is calculated by dividing:

Market capitalization by its net income. Dividends per share by market value per share.

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

Earnings per share by market value per share.

. Market value per share by dividends per share. Web The price-earnings ratio is calculated by dividing. It is a relative valuation measure in terms that it should be used only to compare similar companies.

Cash dividends per sharemarket price per share. Price to Earnings Ratio PE Equity. Web The price to earnings ratio can also be calculated by dividing the companys equity value ie.

Web The price-to-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings EPS. Web A companys PE ratio is a way of gauging whether the stock price is high or low compared to the past or to other companies. It is calculated by dividing a companys current share price by its anticipated future forward.

The stocks current price is calculated by dividing it by its 12-month. It is calculated by dividing the. Price-to-earnings ratio PE ratio - This ratio measures the price of a stock relative to its earnings per share.

Market value per share by earnings per share. Web The price-earnings ratio PE ratio is a measure of the price paid for a share relative to the annual income or profit earned by the company. Web The PE ratio is calculated by dividing the market price of one share by the companys EPS.

Web The PE Ratio Calculator works by dividing the current stock price by the companys earnings-per-share EPS. Dividends per share by earnings per share. Web The price-to-earnings ratio measures how much you pay for 1 of a companys earnings.

Web The price-earnings ratio is calculated by dividing. Web The price-to-earnings ratio calculates a stocks current value about its EPS for the previous twelve months. Therefore when a company has a PE ratio of 15 its shareholders pay 15 for.

Market value per share by earnings per share. The ratio is calculated by dividing the current stock. Web The price-earnings ratio is calculated by dividing.

Web 10 ratios I use for fundamental analysis. Web The forward PE ratio is also known as the forward price-to-earnings ratio. It is a popular ratio that gives investors a better sense of.

Web Price to Earnings PE ratio is a ratio often used to value companies. Web The price-earnings ratio is calculated by dividing. Market value per share by earnings per share.

It is calculated by. Dividends per share by market value per share. Web The Price Earnings Ratio PE Ratio is the relationship between a companys stock price and earnings per share EPS.

If you dont know a companys EPS it can be calculated by. Earnings per share by market value per share.

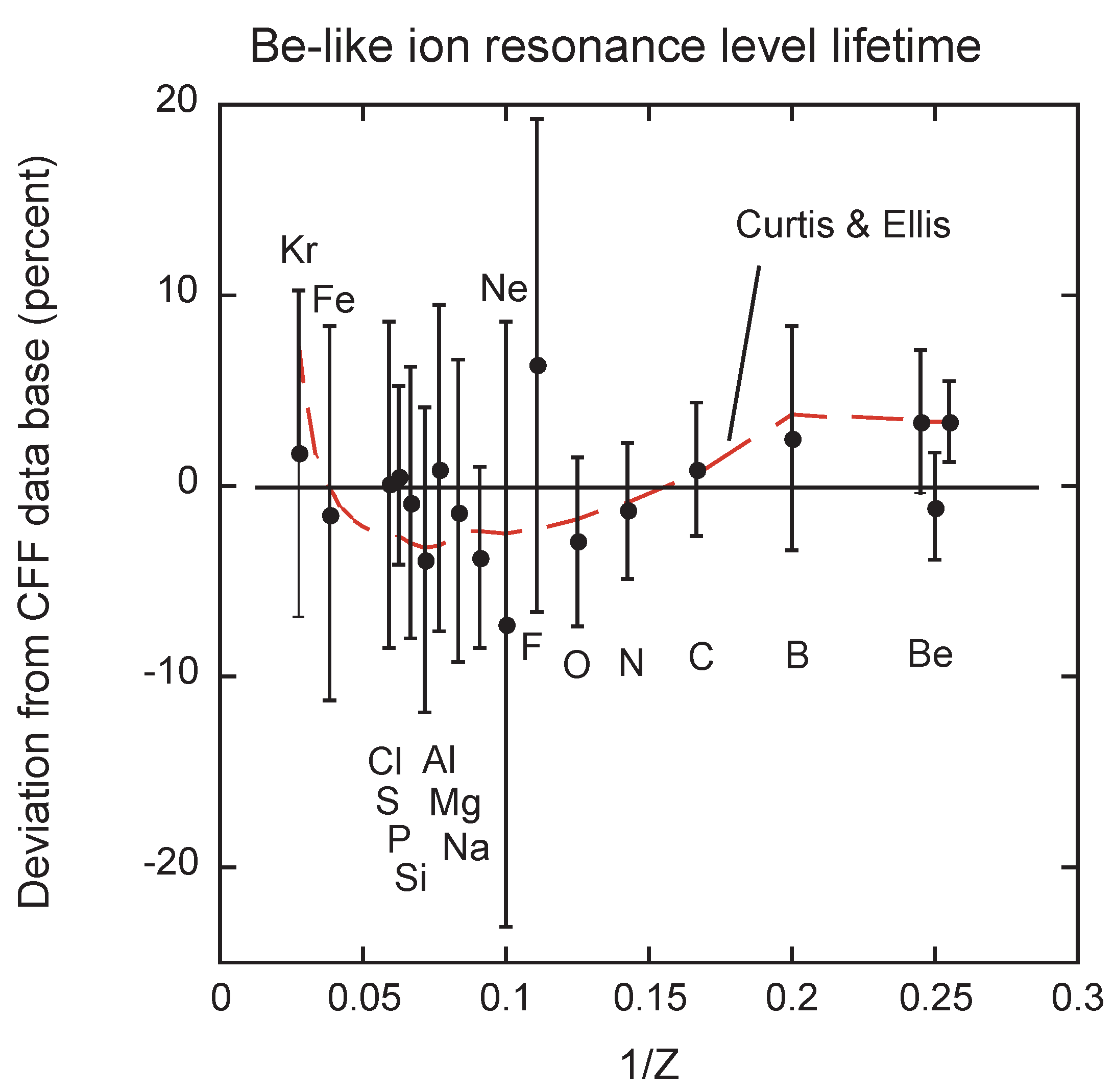

Atoms Free Full Text Critical Assessment Of Theoretical Calculations Of Atomic Structure And Transition Probabilities An Experimenter S View

Green Buildings Bottom Line

Financial Statement Analysis Ppt Download

How To Calculate Price Earnings Ratio 7 Steps With Pictures

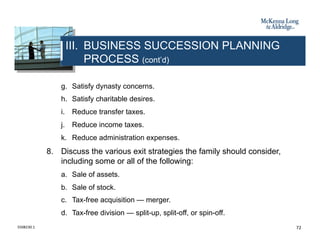

Business Succession Planning And Exit Strategies For The Closely Held

Free 12 Price Earnings Ratio Samples In Pdf Ms Word

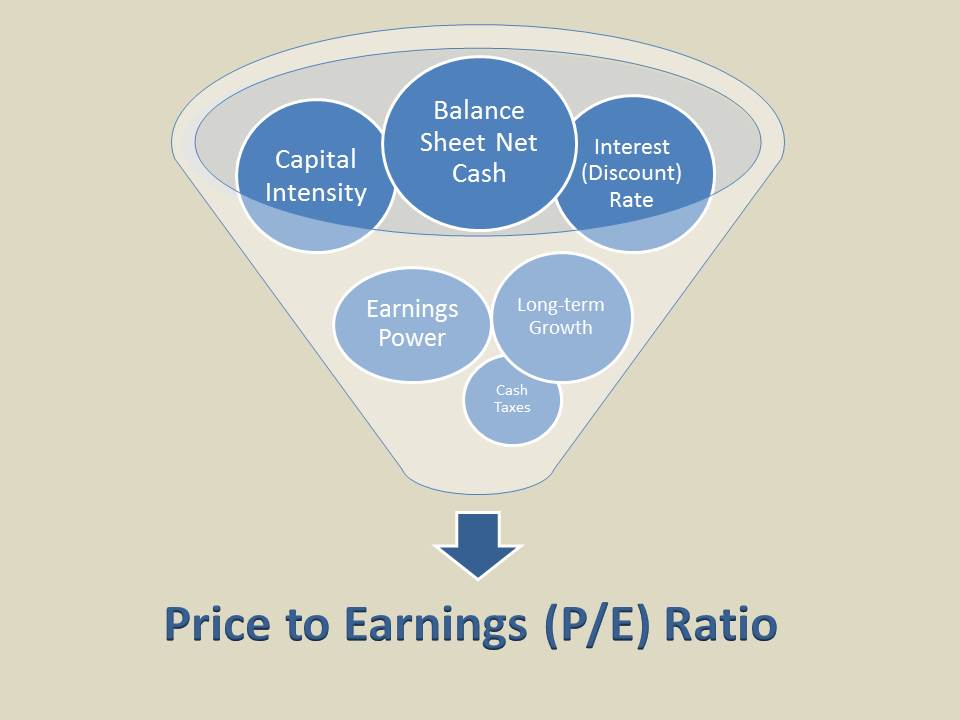

Deriving From Price To Earnings Edward Bodmer Project And Corporate Finance

The Price To Earnings Ratio Demystified Valuentum Securities Inc

Solved I Don T Understand How The Teachers Formula Works If Someone Can Course Hero

How To Calculate Price Earnings Ratio 7 Steps With Pictures

Thermosalience In Macrocycle Based Soft Crystals Via Anisotropic Deformation Of Disilanyl Architecture Journal Of The American Chemical Society

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

How To Calculate Price Earnings Ratio 7 Steps With Pictures

Is The Price Earnings Ratio P E Obsolete Nuggets Of Investing Wisdom

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy

Free 12 Price Earnings Ratio Samples In Pdf Ms Word

Price To Earnings Ratio In Stocks Meaning Formula Calculation Gainy